School Budget Vote Tuesday, May 18

Proposal maintains programming, addresses students’ academic & social-emotional needs

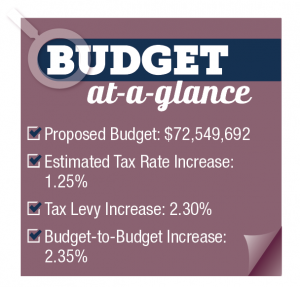

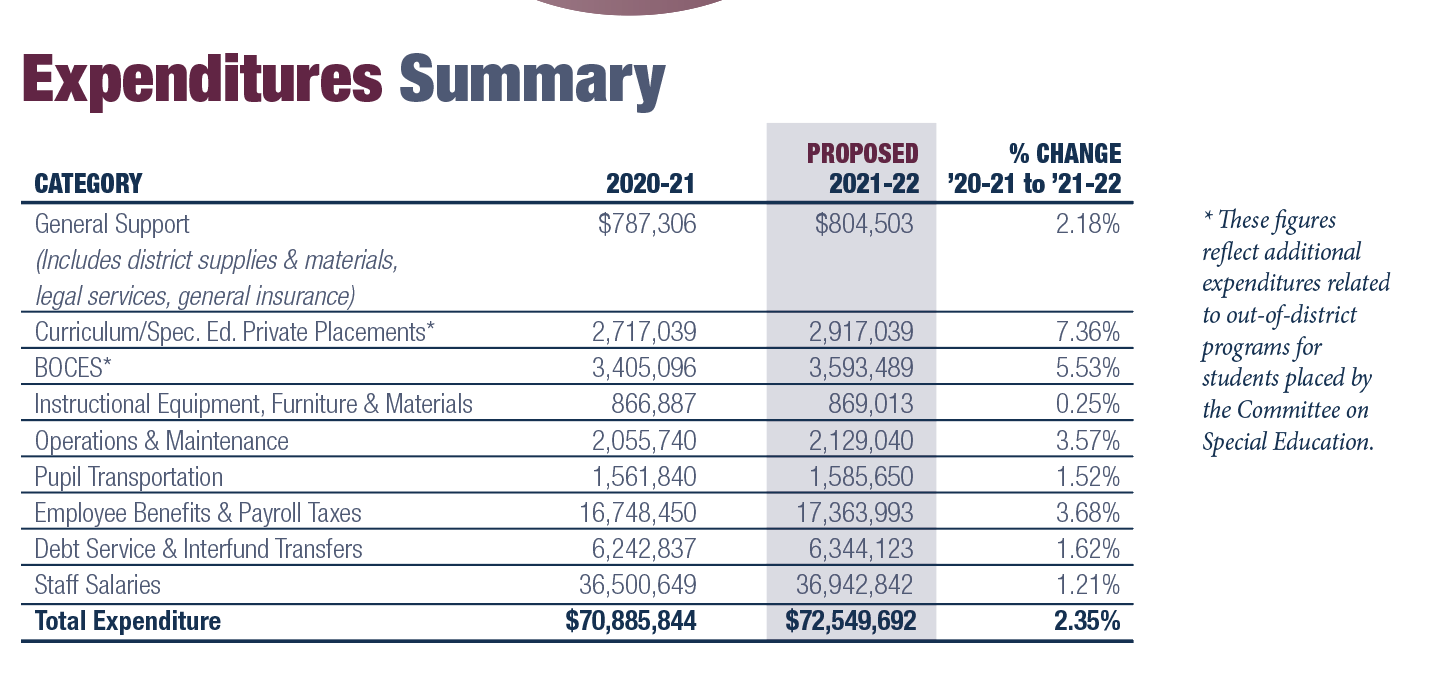

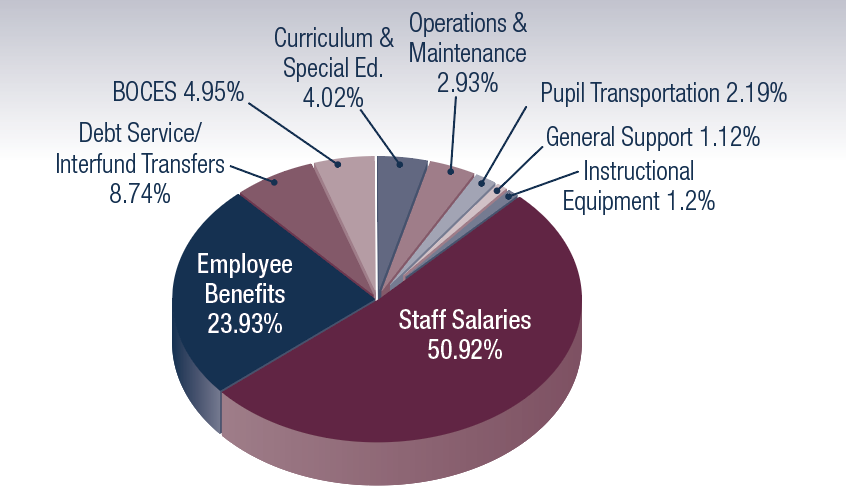

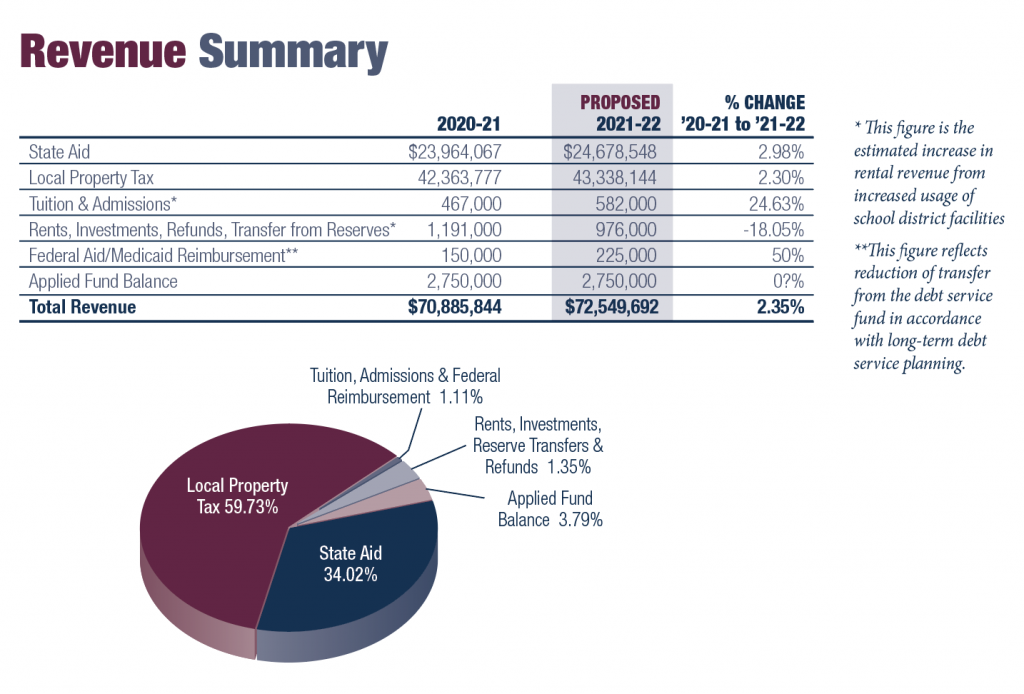

On Tuesday, May 18, Burnt Hills-Ballston Lake School District residents will go to the polls to vote on a proposed $72,549,692 budget for the 2021-22 school year.

Polls will be open from 7 a.m. to 9 p.m. in the gym at BH-BL High School, 88 Lakehill Rd.

The proposed plan preserves all existing programs, restores some previously reduced positions and services, and even expands distance learning opportunities while remaining below the district’s tax levy cap.

The proposal carries a 2.30 percent tax levy increase and results in an estimated 1.25 percent tax rate increase. Voters will also be asked to elect two candidates to the Board of Education and consider a proposition to continue the district’s practice to include an ex officio student member on the board.

Overall spending in the proposed budget will increase by $1.66 million, or 2.35 percent.

For the past several years, BH-BL’s state aid has been relatively flat, and last’s year forecast for potential mid-year aid reductions was concerning for school leaders. As they faced these shortfalls in funding year after year, they relied on careful planning of strategic and significant staff reductions, mostly through retirements, as well as other cutbacks. For the 2021-22 school year, however, the financial situation is shaping up to be a bit different.

“The restoration of BOCES aid, the infusion of one-time federal funding, and the modest foundation aid increase puts the district in a better financial situation compared to the past few years,” explains Superintendent Dr. Patrick McGrath. “Because of this, we are able to present a budget for 2021-22 that maintains student programming and opportunities, restores some staffing and services, and stays below the tax cap.”

While details of the non-recurring federal aid funds are still being finalized, Assistant Superintendent Dr. Christopher Abdoo explains, that districts know the funds must be used for specific, authorized purposes such as restoring in-person learning, curriculum planning, summer programs, social-emotional support, and other services.

What’s new for the 2021-22 school year?

As district leaders continue to analyze the impact the pandemic school year has had on students, they’ve already begun making plans to offer additional academic, social, and emotional supports and services.

“This school year has been like no other any of us has experienced,” says Assistant Superintendent David Collins. “We are still gathering data and feedback, but we know that students have navigated this year’s disruption in many different ways. That’s why it’s important we have the appropriate services available for them next school year.”

The proposed budget:

- restores an elementary school counselor who will split time between the three elementary buildings to provide social-emotional as well as additional academic supports and services for students;

- restores a middle school guidance counselor who will connect with students to ensure they are receiving appropriate academic and mental health supports and services;

- restores the PACE program (that was put on pause due to the pandemic) that provides enrichment/accelerated academic activities for elementary school students; and

- adds more remedial supports, such as Academic Intervention Services (AIS) in math at the elementary level where staff will be able to supplement classroom lessons with additional small-group instruction.

The proposed budget also continues to include efforts to generate revenue. For instance, district leaders will continue to expand distance learning course offerings through the BOCES District Learning Network. Next school year there could be nearly 40 distance learning courses. Some of the new classes students may enroll in include, but are not limited to, Mandarin Chinese I, Russian Language & Culture, Investing 101, Personal Finance Management, Career Internship, Community Service Leadership, Film Design & Production, Digital Arts, and Sociology, as well as several other Fine Arts, Computer Science, and History courses.

“We worked closely with our teachers and K-12 supervisors to maximize the number of courses being offered through distance learning,” says Collins. “Being a part of the Distance Learning Network allows us to broaden our course offerings and provide students with the opportunity to interact with peers from across the region that they might not otherwise interact with. It’s an excellent situation to be in because the district increases its revenue, its course offerings, and its connections with other schools.”

The district will also continue to explore other methods to help drive revenue, such as offering rental of certain district facilities.

2021-22 Estimated Expenses & Revenues

Are new buses being purchased for next year?

Yes, but the cost of the new buses is included in the budget proposal rather than as a separate proposition. Bus purchases are done this way so the district doesn’t have to borrow funds and incur debt. The proposal includes $820,000 for the purchase of five 77-passenger buses, one 29-passenger bus, and a 21-passenger wheelchair accessible bus to replace some of the district’s oldest buses.

The district anticipates being reimbursed approximately 71 percent of the cost of the buses through state transportation aid in subsequent years, resulting in a net local cost of approximately $236,980.

Additionally, by purchasing buses outright, the district saves an estimated $15,000 in interest and legal fees associated with borrowing funds.

Bus replacement plan

The buses scheduled to be replaced in the 2021-22 school year are among the oldest in the district’s fleet and have already accumulated high mileage, exceeded their warranties, and undergone many maintenance repairs. Beyond certain limits, buses typically become too costly to maintain given the state’s stringent safety codes. Furthermore, new school buses are aligned with the latest safety and emissions standards and have better fuel economy rates.

BH-BL’s 69-bus fleet travels more than 750,000 miles a year, transporting more than 3,100 students to and from its five schools. The buses are also used for sporting events, out-of-district runs, shared transportation runs, field trips, summer school, and other events.

In order to keep buses in safe working order, the district’s long-standing policy has been to replace several of the oldest buses each year.

Is there another proposition on the ballot?

Yes! In addition to the first proposition (the 2021-22 budget) residents will also be asked to vote on a second proposition reauthorizing an ex officio student member position on the BH-BL Board of Education. By law, residents must approve this proposition every two years.

This proposition was first proposed and approved in May 2015. For the past six years, a different high school student each school year has been appointed as an ex officio member.

The student member attends board meetings, sits at the board table, and contributes to public discussions. An ex officio student member does not vote and does not attend executive sessions. The student board member is also selected by peers.

What happens if voters do not approve the proposed budget?

Under New York State law, if the school budget is defeated, the BH-BL Board of Education typically has two options: put the same or a modified budget up for another vote on the third Tuesday in June, or immediately adopt a contingent budget. If residents defeat the proposed budget during a second vote, the board must adopt a contingent budget.

Contingent budget rules

Under New York state law, districts that adopt a contingent budget cannot increase the current tax levy by any amount—resulting in a zero percent tax levy increase.

Bringing the BH-BL tax levy increase down to zero would force the board to reduce the proposed budget by $974,367. In doing this, the board may not be able to adhere to its goal of preserving student programs and services or staff, or restoring staffing from prior years. It would also likely have to make a number of staff reductions across all schools, which would increase class sizes.

Adopting a contingent budget also prohibits a district from spending any money in certain areas, including community use of school facilities (unless all costs are reimbursed to the district); new equipment purchases including school buses; nonessential maintenance; capital expenditures (except in emergencies); salary increases for non-instructional and non-unionized employees; and certain field trips and student supplies.

These requirements existed prior to the tax levy cap and remain in effect.

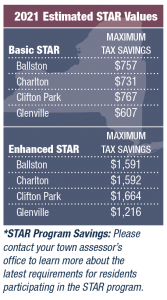

Are there any tax savings programs available to help taxpayers?

Homeowners can receive a property tax exemption or credit under the School Tax Relief (STAR) program.

The Basic STAR* exemption or credit is available on a homeowner’s primary residence for anyone who owns and lives in his/her own home.

Homeowners who earn $500,000 or less can receive a STAR credit. Homeowners earning $250,000 or less can receive a STAR exemption or credit.

The Enhanced STAR exemption is available on the primary residence of taxpayers age 65 and older with yearly incomes of $90,550 or less.

Other tax relief options

BH-BL residents over the age of 65 with incomes of $37,400 or less also can be exempted from paying school taxes on 5 to 50 percent of their home’s assessed value depending on their exact income. The district also grants a disability exemption, ranging from 5 to 50 percent, for qualifying residents of any age with disabilities and incomes of less than $37,400.

The board adopted the Alternative Veterans’ Tax Exemption at level 1, which allows qualifying veterans to be exempted from paying school taxes on a portion of their home’s assessed value depending on their military service.

Applications for these district exemptions and for state STAR program must be filed with your town assessor’s office. Please visit your town’s website or call your town assessor if you have questions.

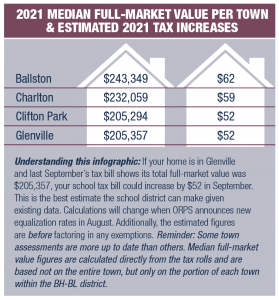

Understanding Tax Levy vs Tax Rate

In the proposed 2021-22 budget, the overall property tax levy will increase 2.30 percent, which results in an estimated 1.25 percent tax rate increase. To understand the impact on homeowners, see the infographic example below.

The tax levy is the total amount that a school district raises each year in taxes from all property owners. The tax rate is the amount of tax paid for each $1,000 of assessed value of property. In a growing district, the tax rate would be lower than the tax levy because the tax levy is spread out over a larger number of property owners.

Calculating tax rate increases is complicated by the fact that BH-BL is made up of parts of four towns. Each year, tax rate increases vary from town to town due to equalization rates that the New York State Office of Real Property Services (ORPS) announces in August. The school district plays no role in determining what portion of the tax burden is placed on any one town or any one property owner.

The state ORPS sets equalization rates that determine the portion of the total tax levy paid by each town, and the assessor in each town calculates individual assessments that determine how much is paid by each property owner. Please contact your town assessor’s office if you have questions about your property assessment or how they determine equalization rates.